General Requirements

The Customs Authority helps the Government of Timor-Leste to control the movement of goods, vehicles, ships, and aircraft that enter and leave the country. As well as protecting our borders from the import or export of illegal or restricted goods, we also help to collect duties and taxes which is an important source of national revenue.

If any of our staff, or representatives from other government agencies, ask you to compete additional steps or requirements, you should ask to speak with a supervisor or manager immediately. Alternatively, you can report information anonymously by calling the Customs Hotline on 12200, or by sending us an online report.

What is a Customs Declaration?

If you want to import or export goods as cargo, by post or by courier mail, you will need to provide us with information about the type of goods, their value, weight, where they are from, etc. This is done by making a ‘customs declaration’. The customs declaration, which is known in Timor-Leste as the Declaracao Aduaneira Unica (DAU), is processed electronically using the ASYCUDA World system. This document allows us to determine what duties and taxes may be due, and to confirm the presence of any required permits or licenses required for other government agencies. In most cases, you will have to use a customs broker to process your declaration.

In some cases, such as you are carrying the goods yourself upon arrival, a customs declaration may not be required. You can learn more about duty free allowances and other exceptions here.

Permits and Licenses

We also work in partnership with other government agencies to ensure non customs related regulatory requirements are also observed for certain goods. In some cases, we will inspect imported or exported goods or accompanying paperwork on behalf of these other government agencies, for example:

- Medicines: Ministry of Health

- Vehicles: Ministry of Transport and Communications

- Foodstuffs: Ministry of Agriculture and Fisheries

Time Limit to Submit Declarations

Imports: When commercial goods enter Timor-Leste, they do so by air or by sea, or via a land border. When the goods arrive, they are initially considered to be in “temporary storage.” After arrival, there is a legal requirement for the goods to be placed under a “customs treatment” within a specified time frame. This means that the goods must be declared to customs as an import, re-exported, or placed in an approved bonded warehouse facility.

Importantly, this must be completed within a strict timeframe, as failure to do so will result in customs issuing you with a financial penalty:

- Arrival by sea: 30 business days

- Arrival by air or land: 20 business days

Exports: Export declarations must be submitted at least 1-working day before the arrival of the exporting vessel.

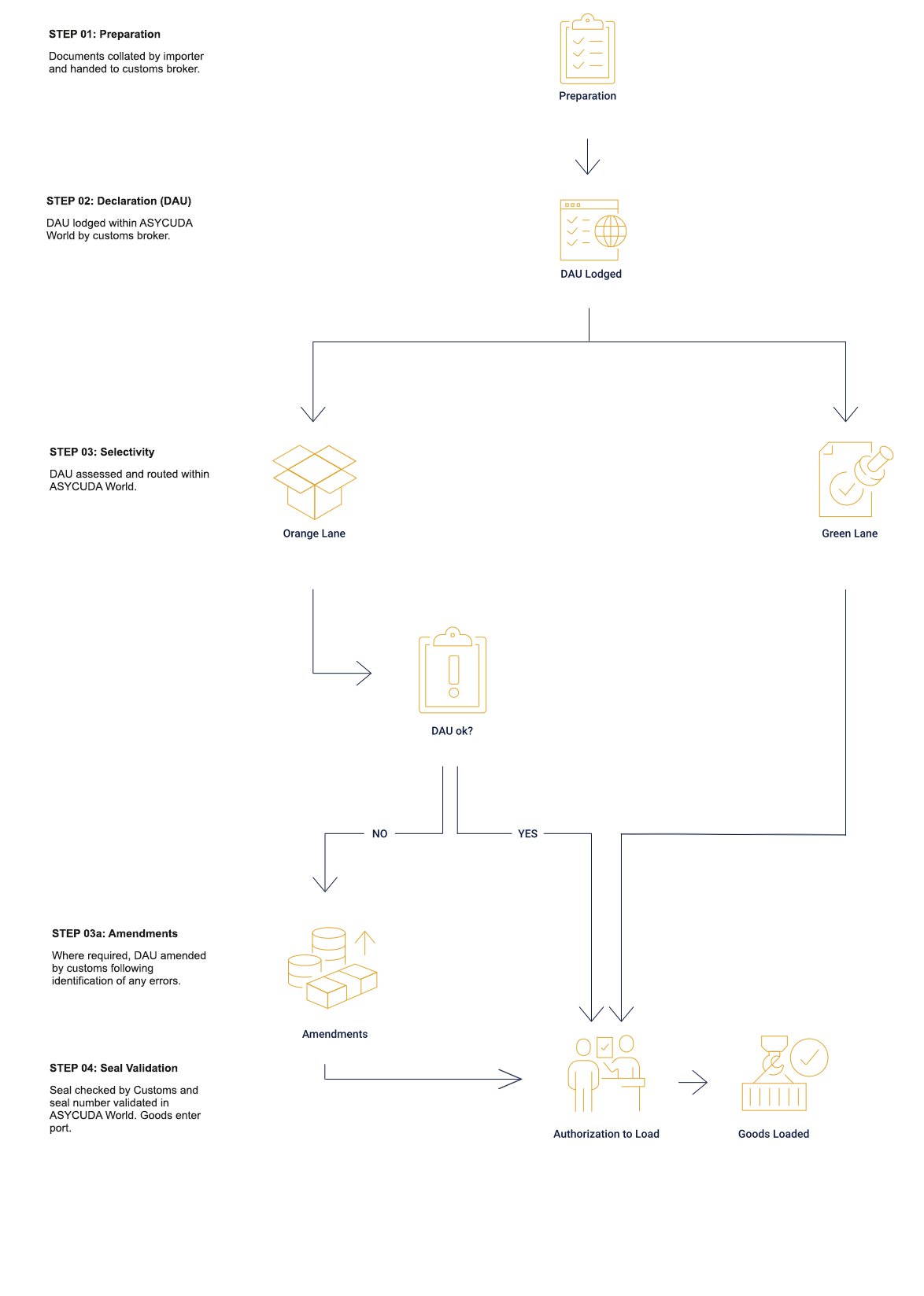

Imports

Importing Goods through Tibar Bay Port

The import process is shown below. To learn more about each step, just click on each icon. You can access and download the full standard operating procedure for importing goods here.

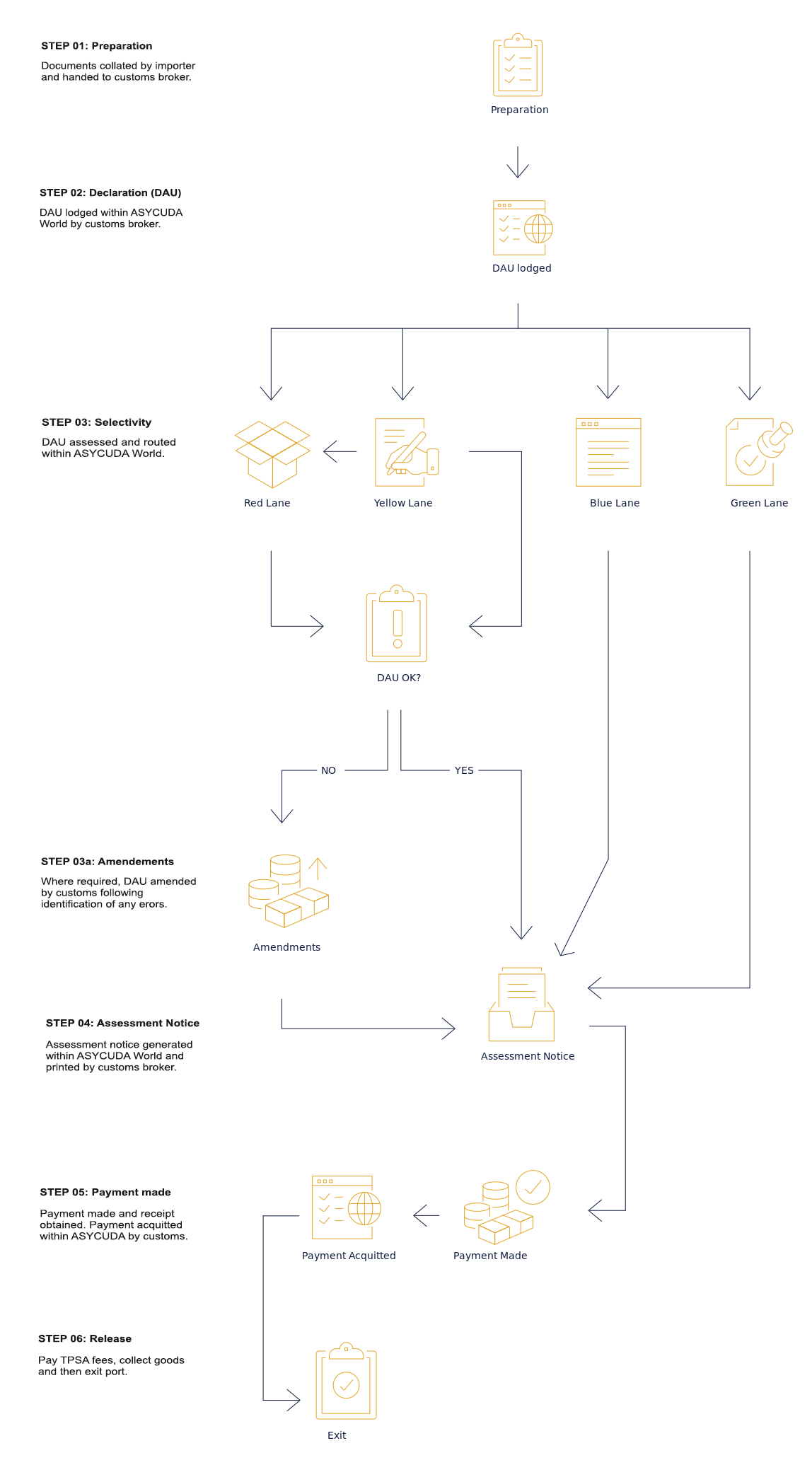

Exports

Exporting Goods through Tibar Bay Port

The export process is shown below. To learn more about each step, just click on each icon. You can access and download the full standard operating procedure for exporting goods here.